Se Nutshell i aktion!

Prøv Nutshell gratis i 14 dage, eller lad os vise dig rundt, før du kaster dig ud i det.

To stay ahead in the banking and insurance sector, financial institutions need a robust CRM system that focuses on managing customer relationships, handling contacts, and providing personalized financial services. This approach enhances customer engagement and optimizes operational efficiency.

Nutshell’s CRM is tailored to meet these requirements. It streamlines workflows, allowing you to direct your time and resources toward delivering secure and efficient insurance and banking services.

Implementing a Customer Relationship Management (CRM) system can greatly improve a financial institution’s operations by streamlining customer interactions and boosting service quality.

For optimal results, banks and insurance organizations should choose a user-friendly CRM that offers a comprehensive view of each customer’s financial history and preferences. This way, you and your team can deliver a personalized service and provide tailored financial recommendations to customers.

By using a CRM like Nutshell, you can elevate customer satisfaction and discover new opportunities for cross-selling and up-selling.

Here are a few key benefits of using CRM software for banks, insurance providers, and related financial institutions:

For banks and insurance providers, choosing the right CRM features is essential as they directly influence operational efficiency and overall customer satisfaction. A well-selected CRM with the appropriate features will enhance customer interactions and provide valuable insights, allowing financial institutions to deliver personalized services and make informed, data-driven decisions.

Nutshell provides a range of CRM features tailored to support financial service providers, including pipeline management, lead management, analytics, reporting, and more.

Here’s how Nutshell’s features can benefit your banking and insurance enterprise:

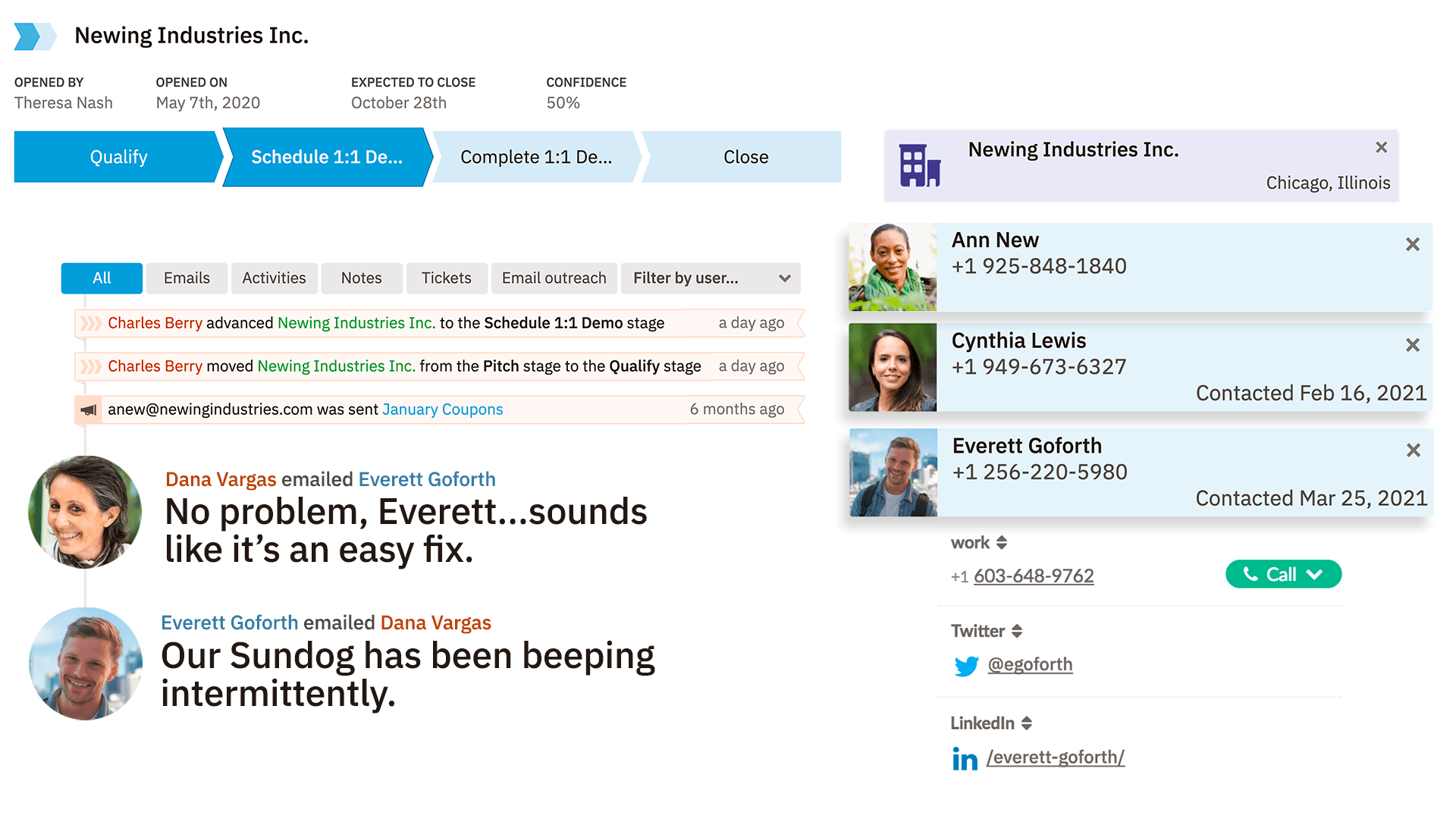

Efficiently store, manage, and monitor customer interactions to maintain comprehensive and up-to-date records. When you have a detailed history of each customer’s preferences, interactions, and transaction history, you can provide personalized service, anticipate customer needs, and resolve errors swiftly.

With Nutshell’s user-friendly contact management solution, you can:

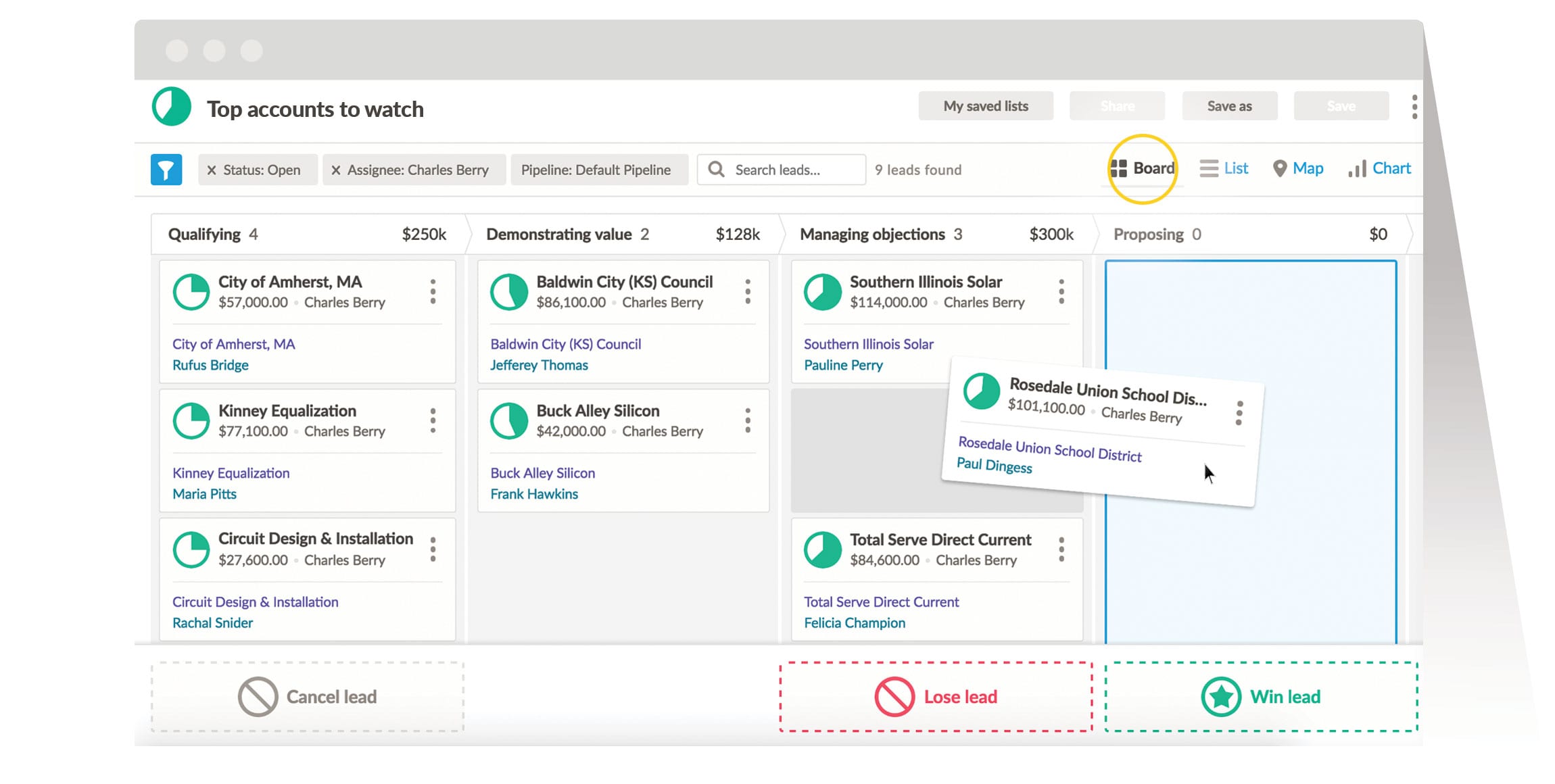

Pipeline management is vital as it offers a clear and organized view of the stages and status of each lead or opportunity within the banking and insurance service sales process. This visibility helps banks monitor progress, forecast future performance, and pinpoint bottlenecks or areas needing improvement.

Nutshell’s robust pipeline management feature ensures that leads are nurtured effectively, deadlines are met, and resources are allocated efficiently, resulting in enhanced overall performance.

With Nutshell’s pipeline management feature, you can:

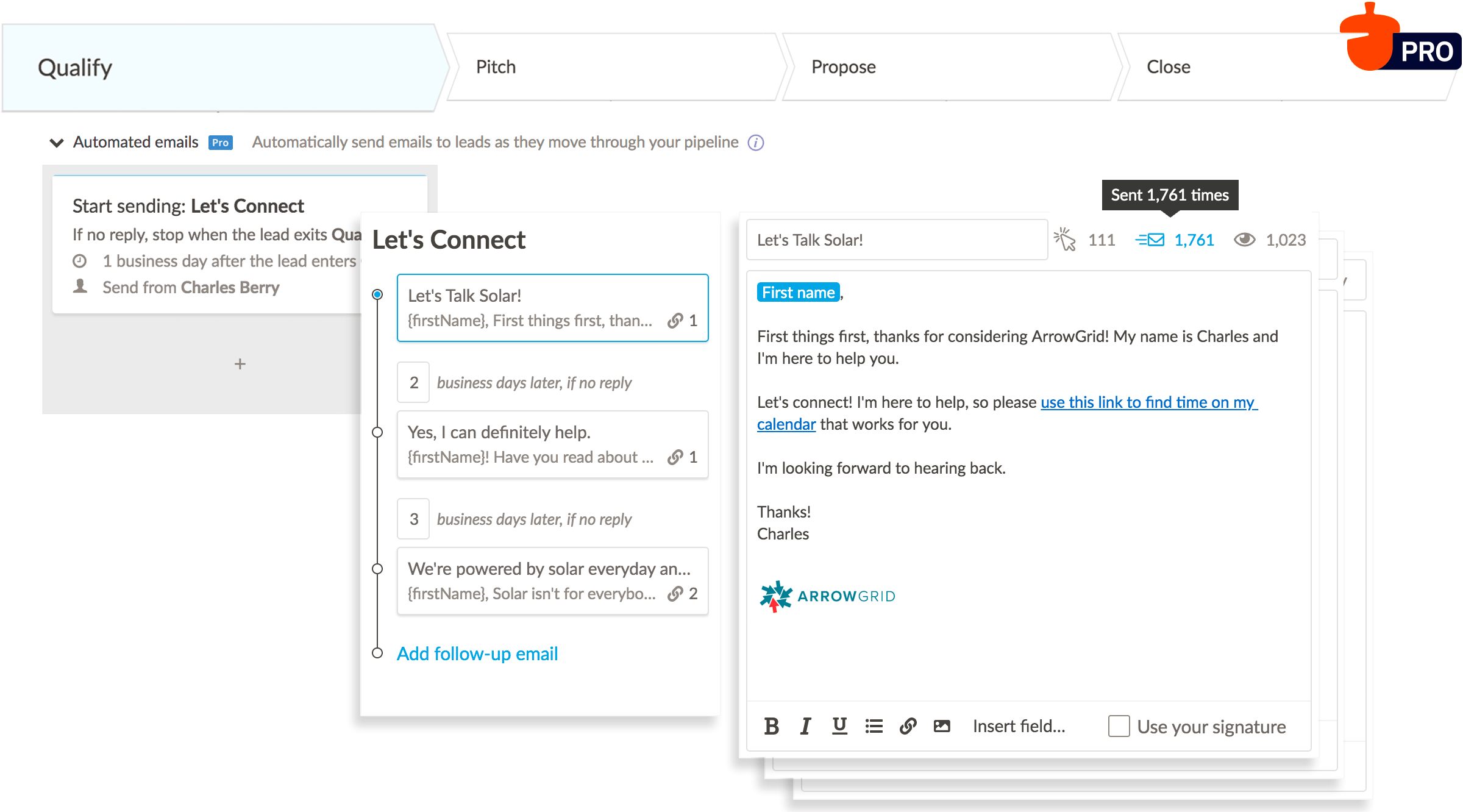

Most companies strive to boost productivity and efficiency. By automating tasks, your team can focus on growing the business through meaningful engagement with potential and current customers.

With Nutshell, you can handle repetitive tasks, like advancing leads and sending follow-ups, allowing you to concentrate on building stronger relationships, maximizing team efficiency, and delivering exceptional customer service.

With Nutshell’s sales automation features, you can:

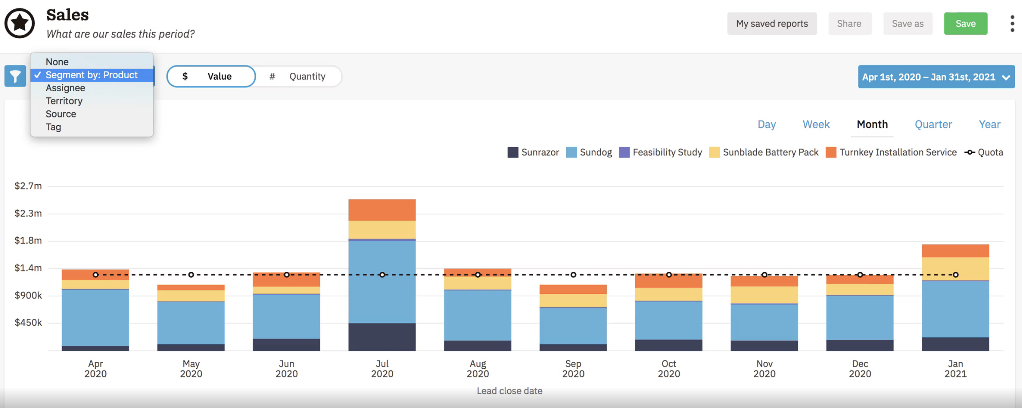

Reliable reporting and analytics software is essential for banks and insurance organizations, as it delivers accurate performance tracking, actionable insights, and supports informed decision-making, risk management, and regulatory compliance.

Nutshell helps you grow your finance business by providing software that shows you what’s driving conversions and identifies where changes and improvements are needed.

With Nutshell’s powerful reporting and analytics features, you can:

AI is transforming how banks and insurance providers serve their customers, streamline operations, and uncover new growth opportunities. Nutshell’s built-in AI tools take the guesswork out of everyday tasks, enabling your team to respond faster, personalize services at scale, and make smarter, data-driven decisions.

With Nutshell’s range of AI features, you can:

Nutshell er den bedste værdi for pengene. Alsidigheden og funktionaliteten gør det til et meget nemt og kraftfuldt produkt at bruge.

Mark M. Southwestern Scale Co.

Jeg har tidligere brugt Act, Goldmine og Salesforce, og jeg synes, at Nutshell var det nemmeste at komme i gang med og at oprette brugerdefinerede felter. Jeg vil anbefale Nutshell til andre, der er interesserede i et CRM, der er nemt at lære og navigere i.

Craig C. Thermal-Tec

Vi forlod Hubspot til fordel for Nutshell , fordi Hubspot var for kompleks. Nutshell laver software til mennesker.

Daniel H. EOS

Da vi evaluerede CRM-systemer, var den eneste afgørende faktor mellem Nutshell og Salesforce opstartstid og pris. Nutshell vinder på begge punkter (med stor margin). Salesforce kostede 10 gange så meget pr. måned for det, vi ønskede.

Jason C. Arrow Container Corp

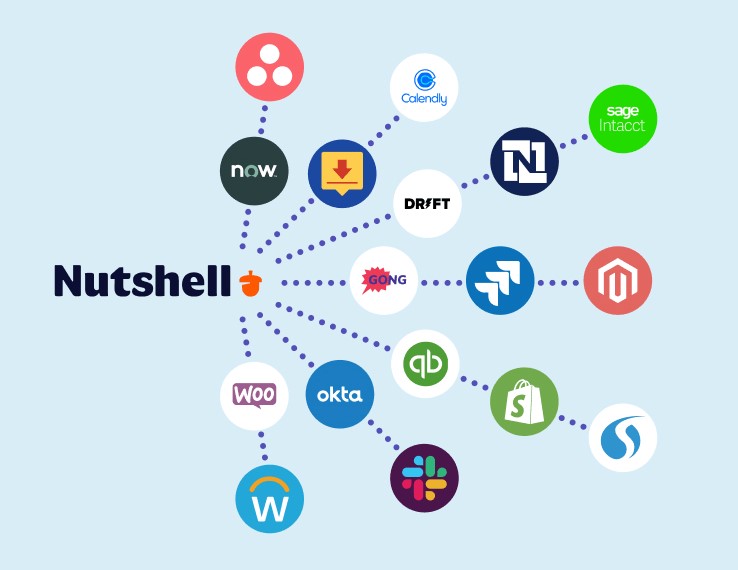

Investing in a CRM system offers banks and insurance entities the benefit of enhanced software integrations, creating a more efficient, accurate, and insightful environment. By integrating your CRM with other essential finance tools, you can streamline operations and improve performance.

Here are some powerful integrations offered by Nutshell’s CRM for banking and insurance:

Success in the banking and insurance industry is built on strong relationships and exceptional customer service, aiming to retain existing customers, as well as attract new customers and expand business. To achieve this, financial service provider employees must use software that automates repetitive tasks, makes key information easy to find, and helps teams provide the best possible customer experience.

Nutshell CRM is a leading choice for banks and insurance institutions due to its intuitive interface, extensive customization options, and robust integration capabilities. It streamlines customer management and enhances financial services by centralizing client interactions, automating workflows, and providing actionable insights, which helps manage complex banking relationships and boost operational efficiency.

By choosing Nutshell as your insurance and banking CRM solution, your team will benefit from:

Our customers have lots to say about our CRM software. Check out our customer stories to learn more about how Nutshell has helped companies just like yours achieve and exceed their goals!

These Marketing & Engagement features are included with every CRM subscription: Webchat, AI Chatbot, Form builder, Landing pages, Email Marketing capabilities & Attribution reporting.

Prøv Nutshell gratis i 14 dage, eller lad os vise dig rundt, før du kaster dig ud i det.

When you choose Nutshell as your banking CRM, you have the option to partner with 500+ digital marketing experts to help drive leads to your sales team.

Nutshell delivers cutting-edge features and exceptional customer support designed to boost the productivity and efficiency of your financial institution. We simplify your operations by streamlining client interactions, automating routine tasks, and managing leads—all from one comprehensive platform.

Explore how Nutshell can transform your banking and insurance operations by signing up for a 14-day free trial—no credit card required. Alternatively, reach out to our sales team to discuss your specific needs, learn more about our solutions, and get answers to any questions you might have.

Most teams get up and running within days. Nutshell’s intuitive interface means minimal training required. For data migration from systems like Salesforce or HubSpot, we handle the heavy lifting through our Import2 partnership, starting with a sample migration to ensure accuracy before the full import.

Yes. Nutshell uses bank-grade 256-bit TLS 1.2 encryption for all data in transit and at rest. We’re GDPR-compliant, PCI-compliant for financial data, and completed a Cloud Application Security Assessment (CASA) validating alignment with industry security frameworks. Your data is stored securely on Amazon Web Services.

Absolutely. Nutshell’s custom fields feature lets you create pipeline-specific fields tailored to your products. You can set up separate pipelines for loans, mortgages, and insurance products, with custom fields visible only where needed. This keeps your team organized and focused on the right information.

Nutshell eliminates silos with centralized customer timelines where all interactions live in one place. Teams can @-mention colleagues, comment on customer records, and stay notified of updates. Role-based permissions ensure secure access, while integrations with tools like Slack keep departments connected across your tech stack.

Nutshell supports direct migrations from 25+ CRMs. We start with a sample migration to verify data mapping, then request approval for the full migration. Our support team handles the technical work, and you can monitor progress throughout. Most migrations complete smoothly without data loss, so you can transition your team with confidence.

Slut dig til mere end 30.000 andre professionelle inden for salg og marketing. Abonner på vores Sell to Win-nyhedsbrev!