Forget juggling multiple apps to manage, quote, and invoice sales prospects. Streamline your sales-to-payment process for faster payments and enhanced cash flow with Nutshell Invoices.

When prospects say “yes,” the hard work isn’t over—you still need to get the money in the bank. Jumping between spreadsheets, PDF builders, and accounting tools steals time from essential sales activities and opens the door to costly mistakes.

Nutshell Invoices turns the quoting momentum you’ve already built into quick and clear invoices that help you close the revenue loop without ever leaving your CRM. Track and manage professional invoices in seconds, so cash can flow in while you keep selling.

Nutshell Invoices is an update to our Quotes add‑on (now Nutshell Quotes & Invoices) that empowers your team to generate branded, itemized invoices the moment a deal is ready to bill.

Because it lives inside Nutshell, every invoice automatically pulls the customer, product, and pricing details you’ve already captured—eliminating re‑typing, reducing errors, and giving you one source of truth for every deal.

Nutshell Invoices simplifies your billing workflows from proposal acceptance to payment request and invoice management. These are a few of the central functions of Nutshell Invoices:

Our detailed support article breaks down exactly how to set up Nutshell Invoices and all the features you’ll have at your disposal to help you get paid faster.

Nutshell Invoices is available as part of our Nutshell Quotes & Invoices add‑on for a flat rate of $67 per month. To get started, head to your billing page in Nutshell and add Quotes and Invoices to your plan.

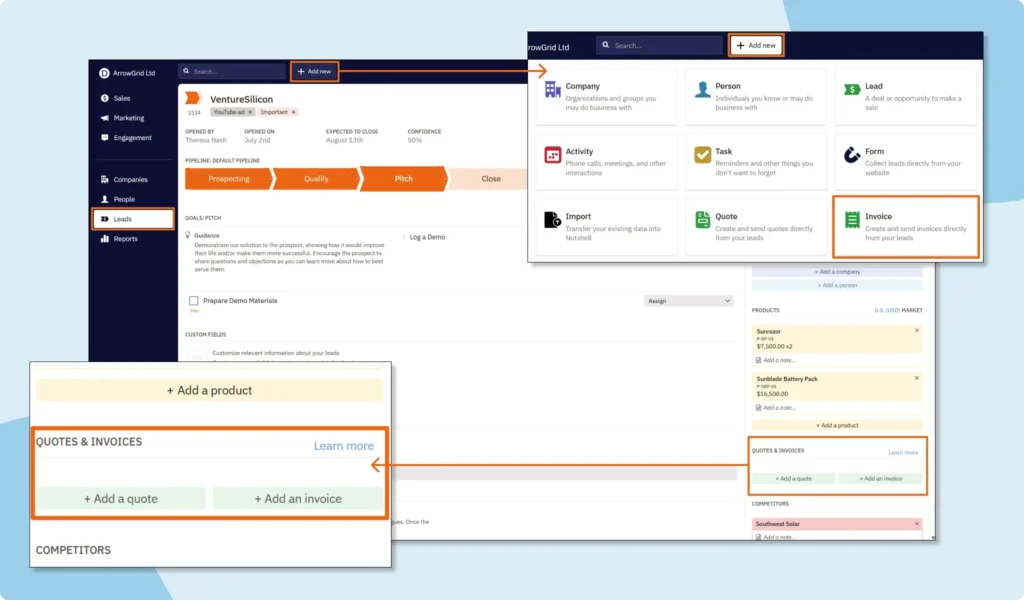

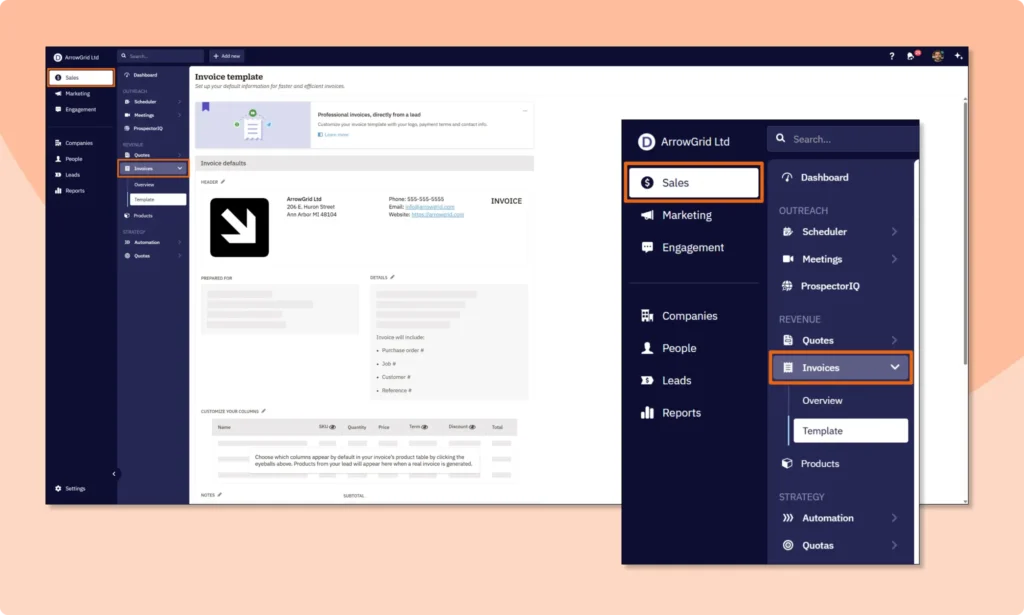

Once enabled, simply use the “+ Add new” menu or the Quotes and Invoices sidebar section on a Lead page to build your first invoice. Add your company logo, terms, taxes, and payment links before or when creating your first invoice. Include notes, discounts, PO numbers, shipping, and more with ease before reviewing and sending.

Integrating invoicing with your CRM isn’t just about sending bills; it’s about transforming your entire sales-to-payment cycle. Beyond the basic ability to create and send invoices, Nutshell Invoices centralizes your financial data with your customer interactions. This means:

Absolutely! For businesses with subscription models or recurring services, Nutshell Invoices takes the headache out of repetitive billing. While the main article focuses on one-off invoices, Nutshell’s robust capabilities extend to managing recurring revenue with ease. You can:

Nutshell Invoices is designed to be the central hub for your sales-to-payment process, but we understand that it’s part of a larger financial ecosystem. While Nutshell directly handles the creation, sending, and tracking of invoices, it facilitates seamless integration with popular accounting software and payment gateways to ensure a unified financial system.

Your invoices are an extension of your brand, and Nutshell Invoices offers robust customization options to ensure they look professional and meet your unique business needs. Beyond simply adding your company logo, you can:

Nutshell Invoices isn’t just a billing tool; it’s a powerful source of data that, when analyzed, can provide invaluable insights into your business’s sales performance and overall financial health. By keeping invoicing within your CRM, you can:

When evaluating a CRM with invoicing capabilities, look for: seamless quote-to-invoice conversion, automatic payment tracking, customizable invoice templates, payment reminder automation, and integration with your payment processor. Nutshell Invoices includes all these features at a flat rate of $67/month.

An invoice management CRM keeps your billing and customer data in one system. Unlike standalone billing software, you don’t need to manually transfer customer information, pricing, or deal details. Everything flows automatically from sales conversations to invoice creation, reducing errors and saving time.

Nutshell Invoices gives you a seamless, end‑to‑end payment process flow—from quote to cash—inside the CRM you already trust. Jump in today to start sending invoices and get payments in faster. Contact our support team if you need help getting started or have any questions.

Create, send, track, and manage invoices without leaving your CRM! Discover how Nutshell Invoices speeds up cash flow management and keeps revenue moving.

Join 30,000+ other sales and marketing professionals. Subscribe to our Sell to Win newsletter!